CBDC #2: Taxonomy

Definitions and Divisions of money and Central Bank Digital Currencies (CBDCs)

In our continued exploration, we embark on a journey to contextualize Central Bank Digital Currencies (CBDCs) within the annals of financial history. As we delve into the taxonomy of CBDCs and delve into their conceptual foundations, we strive to forge a cohesive understanding of their origins and implications.

Establishing a Common Lexicon: Defining Core Terms

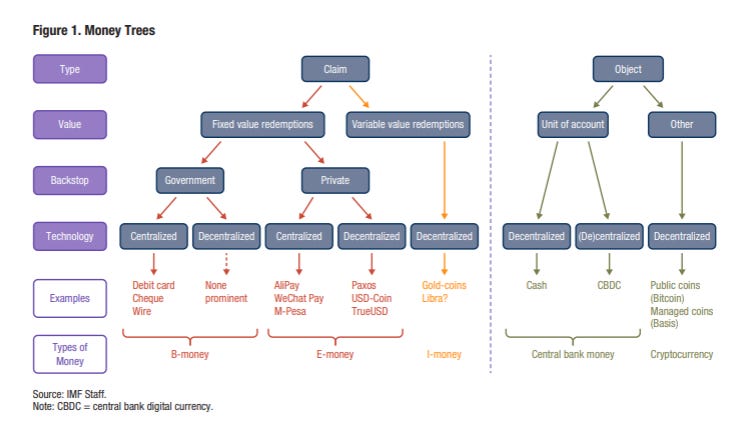

To establish a foundation for our research, we endeavor to devise a standardized set of definitions. We navigate the intricate realm of financial instruments, delineating the terminologies that underpin our discourse. These core terms include Gold, Cash, Bank Money or Credit, Reserve Money, E-money, and Cryptocurrency. By delving into this taxonomy, we lay the groundwork for a comprehensive examination of CBDCs.

Intriguingly, we endeavor to kindle motivation for the conception of digital money by assuming the role of an actor seeking to compromise a digital payment system. Upon scrutinizing the landscape, we discern that in the realm of Bitcoin, denoting the encompassing decentralized currency market, the probability of compromise remains remarkably low. Consequently, Bitcoin assumes a semblance of permanence in this regard. This permanence signifies that as the demand for digital payments surges, Bitcoin stands poised to capture a substantial share of this burgeoning market.

Unveiling Historical Precursors: A Glimpse into a Global Currency

Traversing further, we encounter the resonance of historical precedents that foreshadow the emergence of a global currency. Yet, in the mosaic of financial evolution, certain elements beckon consideration. The archetype of barter, acting as a precursor to money itself, elicits contemplation. While the comprehensive evolution of money remains a subject of varied chronicles, the paramount transition from gold to cash and subsequently to credit reverberates as a cardinal narrative. The transformative impetus therein lies in technology, culminating in the profound shift from object-based to claim-based payments.

Deciphering Money's Essence: An IMF Perspective

Striving for clarity in our endeavor, we delve into the quintessence of money itself. We unravel the dichotomy between object-based and claim-based money, presenting a dichotomy that informs the mechanics of transactions. The act of transaction is fundamentally enshrined within the realm of object-based money, wherein cash and gold symbolize tangible assets exchanged for goods and services. In contrast, credit cards and digital payment platforms like Venmo and E-money engender a distinctive paradigm. These mediums, which do not necessitate the direct exchange of assets, leverage a network of intermediaries to ensure transaction validation. The federal reserve system occupies a parallel space with a similar operational framework.

The fulcrum of distinction lies in the premise of authority to validate transactions. While cash and gold operate as objects of exchange, credit and the majority of contemporary currency are underpinned by the exchange of claims. Although the claim-based payment model predates our era, it is the technological surge of the past century that has invigorated its expansion. Platforms such as Venmo and Cash App embody commonplace modes of transaction in the United States. Meanwhile, Apple's introduction of credit cards and China's widespread use of Alipay serve as testament to the global penetration of these claim-based mechanisms.

Economic Functionality: The Triad of the Functions of the Money

Within the United States, the connotation of money assumes a triadic confluence of economic functionality. Categorized by three pivotal functions—Medium of Exchange, Store of Value, and Unit of Account—the intricate tapestry of money's role is woven. While individuals employ banknotes as mediums of exchange, financial institutions leverage deposits to facilitate credit creation and investment returns. Meanwhile, central banks wield reserves as units of account to oversee credit activity and collect taxes. This categorization endows money with a multidimensional role that traverses individuals, financial institutions, and central authorities.

The Dynamics of Digitalization: Maturity and Variation

The functions of money, delineated by technology maturity, are loosely characterized by distinct modes of implementation. The Unit of Account function finds its embodiment in Bank Reserves, meticulously tracked in electronic format. Store of Value is channeled through Bank Deposits, held electronically via applications accessible through ubiquitous smartphones. Finally, the Medium of Exchange is epitomized by physical Cash issued by the Federal Reserve.

Amid the strides taken by digital claim-based payments to facilitate economic expansion, an intricate interplay emerges. This interplay lays bare the financial system's heightened dependence on third-party intermediaries, subsequently engendering concerns surrounding financial oversight, monetary policy transmission, and the very sovereignty of monetary governance. This paradigm shift invokes profound inquiries that delve into the broader implications and nuances of financial innovation.

Bitcoin's Abstract Placement: Redefining the Paradigm

To encapsulate Bitcoin's role within this framework, we must adopt a more abstract perspective. In its most contemporary iteration, the definition of money delineates between digital claims and tangible objects. Bitcoin, however, ventures beyond this binary. Analyses from diverse vantage points yield two resonant analogies:

First, Bitcoin can be likened to "Digital Gold." Similar to gold, Bitcoin's utility encompasses both present and future applications, accompanied by a direct ownership structure for each unit. However, akin to gold, it lacks future cash flows essential for valuation.

Secondly, the Bitcoin network itself can be construed as a quasi-bank. This virtual bank defies conventional governance frameworks, devoid of a board of governors or established monetary policies. Instead, it thrives upon the demand-driven sustenance of its open-sourced infrastructure, supported by capital and internet access.

As we voyage through these multifaceted perspectives, our understanding of Central Bank Digital Currencies, their historical antecedents, and the ever-evolving nature of money attains a heightened depth. The symphony of technology, finance, and human ingenuity converges to compose a narrative that transcends epochs, anchoring the contemporary financial landscape in the throes of innovation.

Previous: Episode 1: Unveiling the Digital Financial Frontier

Next: Episode 3: Historical Comments from Friedman and Keynes on the future monetary system

Content edited with Chat-GPT

Image Source: IMF

Support:

ETH: 0x061FC76f7fc425bA5e4551a13cDD1dd16a97ecF9

Cashapp: $CJSchaffer